Inflation Impacts on Multifamily Housing

From Cardinal Group Consulting

In June 2022, inflation reached a 9.1% peak, the highest consumer price index (CPI) in a 12-month period since 1981, according to the U.S. Census Bureau. While the CPI began to cool in July 2022, it was still up 8.5% and remained at a 40-year high for nine consecutive months, the biggest price surge since the 1981-1982 time period. The Federal Reserve has hiked interest rates in an effort to cap the staggering price increases, but in the meantime, we are seeing both the negative and positive impacts inflation is having on multifamily housing in terms of operational expenses, rental rates, resident retention, collections, and development activity.

Operating Expenses

When looking at the negative impacts inflation has on multifamily housing, an increase in operating expenses is at the top of the list. The prices of products and services, payroll, insurance premiums, and taxes have all increased. According to NAHB’s Multifamily Market Survey, employee compensation costs in the multifamily sector rose 12% YOY, with leasing managers or agents’ wages increasing 9.4%. While an increase in wages affects operating expenses, it also provides renters the ability to afford the rising rental rates.

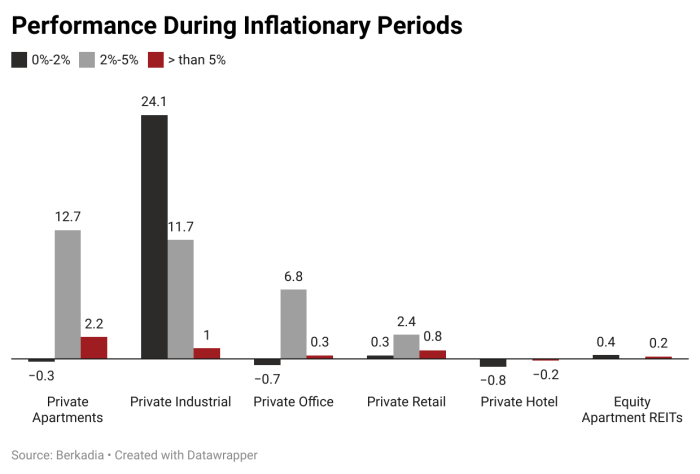

The ability to offset rising operational expenses with rent growth likely contributes to multifamily being a peak performer during times of inflation. An analysis completed by Berkadia found that while nearly all commercial real estate product types respond favorably during inflationary periods, private apartments outperformed other sectors during both times of moderate and high inflation.

Rental Rates

Post-pandemic 2021 signaled a year of record rent growth in the multifamily sector. Rates not only rebounded from the pandemic but rose more than double any previous year. Rent growth has held steadfast in 2022 as the average Class A and Class B effective rents grew 17% YOY and Class C apartment rents climbed by 12% YOY through June. As a comparison, rents grew 7% to 12% each year during 1974 to 1985, a span that included three separate economic contractions. While strong supply and demand metrics have contributed to the most recent rent growth, it is undeniable that inflation has also played a role, as the cost of shelter rose 5.6% over the past year, the largest 12-month increase since February 1991.

Resident Retention

Inflation has not only affected the price index of consumer goods and rental rates, it has significantly affected the prices of single-family homes. Exceptionally high home prices coupled with rising interest rates have forced prospective homebuyers to continue to rent. This inability to purchase a home preserves the current demand for multifamily housing, resulting in higher renewal rates. As of June 2022, the average resident retention rate for multifamily reached 56.1%, up 20 bps year-over-year with the trailing 12-month average of 57.6% up 390 bps year-over-year.

Rent Collections

While inflation contributes to higher rent growth and occupancy, many fear it could lead to an increase in bad debt. A survey conducted by Freddie Mac revealed that 1 in 5 renters, or 19%, who experienced a rent increase, responded that they are likely to miss a rent payment. While this renter sentiment may seem concerning, according to RealPage, data shows otherwise, as rent collections for market-rate apartments averaged between 95%-96% since March 2020, with pre-pandemic collections trending only slightly higher at 96% to 97%.

Rent collection is, of course, impacted by wage increases, as well as extended price surges of other consumer goods such as fuel and food. While food and fuel increased significantly, 10.4% and 60.2% respectively (this exceptionally large increase is for the 12-mo period from June 2021 and is somewhat misleading given the shock fuel prices felt from COVID last summer), wages and salaries increased 5.3% for the 12-month period ending in June 2022, which helped offset increases in rental rates and contributed to strong collection rates. Moving forward though, job and wage growth should be closely monitored, as a decrease in earnings or a rise in unemployment could easily trigger an increase in bad debt.

Development Activity

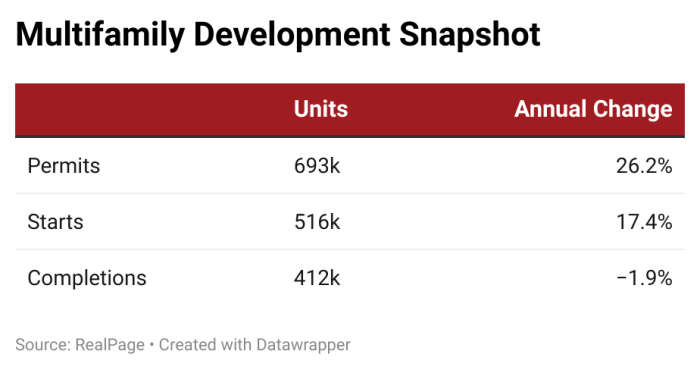

Skyrocketing prices for steel, lumber, and fuel, and a significant cost increase of skilled labor has directly impacted construction. Supply chain issues and pressures to complete stalled projects due to the pandemic has created a bottleneck which is feeding inflation. While there is an evident need for more multifamily apartments, the question remains if new projects are feasible with these cost increases and if residents have the ability to off-set higher costs by paying higher rent. According to RealPage, over 426,000 units are under construction and slated to deliver by the end of 2022, however this record-setting activity is likely compounded by pandemic setbacks. Construction delays are already piling up in 2022, as the number of multifamily units permitted but not started has risen 47%, roughly 147,000 units since July 2021.

While operating expenses have been rising during this inflationary period, multifamily has the unique advantage of combating expense increases with rent increases. Even though rents have surged the last year, it can be argued that there is still ample room for growth, simply based on the percentage of income that renters are spending on housing costs. A report conducted by RealPage concluded that, “market-rate apartment renters signing leases so far in 2022 are spending only 23.2% of income toward rent, up modestly from pre-pandemic norms, but still well below the traditional affordability ceiling of 33%.”

Offsetting escalating expenses with appropriate rent increases while also maintaining affordability and low vacancy rates can be a delicate balancing act. A strong property management partner, like Cardinal Group Management, should be monitoring inflation levels as well as analyzing supply and demand metrics to make appropriate decisions for every asset. Recognizing rising costs and proactively addressing rates and occupancy projections is imperative in order to counter inflationary pressures while still achieving a favorable NOI.

About Cardinal Group Consulting

Cardinal Group Consulting specializes in providing consulting services to the student housing and conventional multifamily industries as well as niche sectors such as built-to-rent. We provide a diverse range of services including market research, due diligence, capital planning and pre-development design. For more information, contact consulting@cardinalgroup.com