Discussing Trends in Denver’s River North Neighborhood

Cardinal Group Consulting was recently engaged to provide an assessment of Denver’s RiNo neighborhood. It’s amazing to see how this area has changed in just a few short years. Since 2017, the RiNo submarket has seen 2,570 new units delivered, an increase in total supply of nearly 160%. In 2021 alone, RiNo accounted for roughly 35% of new units delivered across the Downtown Denver market.

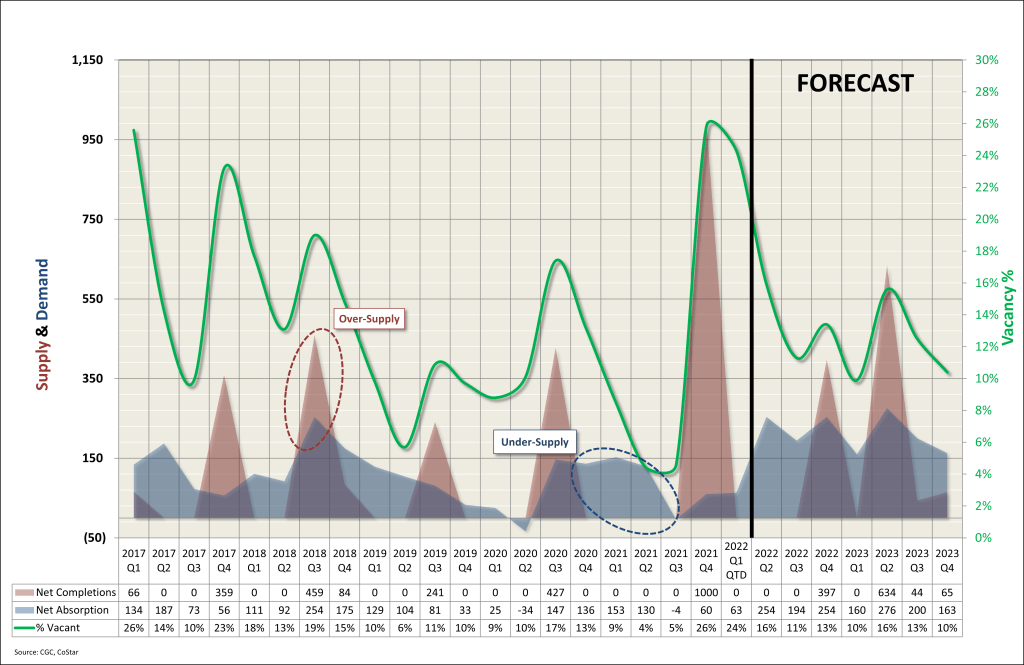

Given the limited existing inventory and substantial development pipeline, it’s not surprising to see the submarket average ~15% vacancy rate from Q1 2017 – Q4 2021. During this period, the neighborhood has seen effective rent growth of ~14%. But the vast majority of this rent growth was seen in 2021, as average rents rose from $1,728/mo to $1,974/mo (14% growth) from Q4 2020 – Q4 2021. Along with strong rent growth, 2021 also saw a significant contraction in vacancy, falling from ~18% in Q3 2020 to 5% in Q3 2021. In Q4 2021, another 1,000 new units delivered, which caused vacancy to spike back up to 26%.

As the chart below illustrates, the RiNo neighborhood has exhibited strong absorption throughout the development boom of the past five years; although there have been large vacancy spikes following new deliveries, these periods have been short-lived. Additional pent-up demand from potential residents returning to the neighborhood should only serve to quicken absorption rates moving forward.

Although there are still nearly 1,200 units in the RiNo pipeline, the neighborhood has proven its ability to absorb new units and should continue to see improved occupancy and strong rent growth moving forward.

Is your group interested in digging deeper into market or sub-market trends? Cardinal Group Consulting can provide similar insights into markets across the country. Find out how we can help illuminate trends and inform your strategic decisions.

Learn more at https://cardinalgroup.com/consulting/.