Can Cubicles Solve the Housing Crisis? A Look into Office to Multifamily Housing Conversions

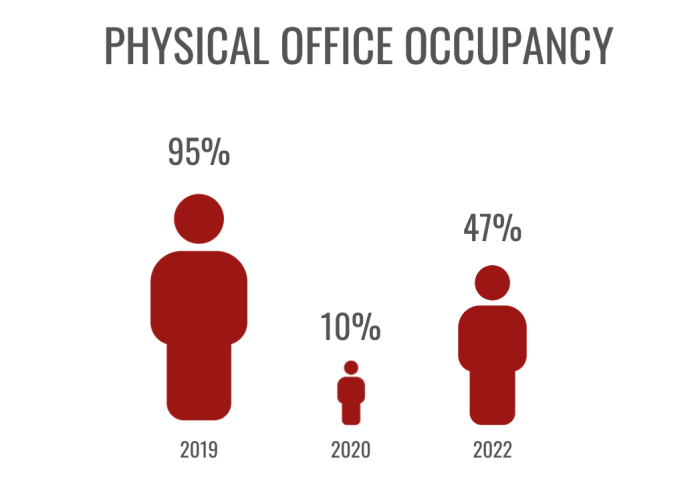

Lately, office-to-apartment conversions have been making headlines. With the pandemic kickstarting remote work, high office vacancies have led owners to consider converting these spaces into multifamily housing, a sector that has remained resilient throughout the pandemic and has historically fared well during economic downturns. The US National Bureau of Economic Research (NBER) reports that offices in major markets were 95% physically occupied prior to the pandemic, however, by the end of March 2020, occupancy dropped to 10%. Fast forward to September 2022, and physical office occupancy has crept back to only 47%.

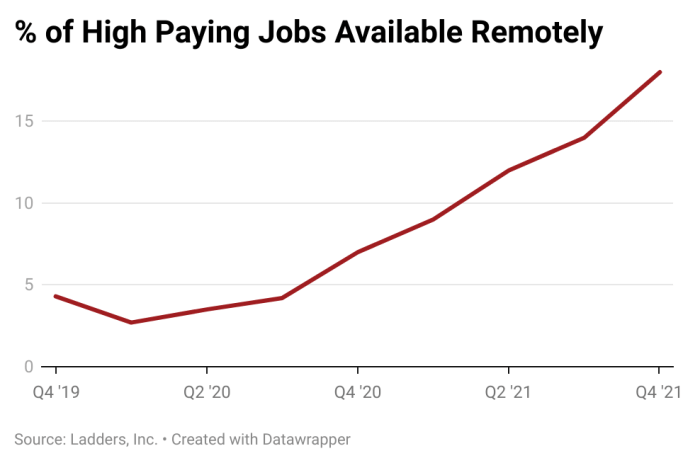

One could argue that as employers transition back from telework to in-person, occupancy will increase, except Gallup anticipates 24% of workers remaining exclusively remote and 53% having a hybrid work arrangement moving forward. Ladders, which has been tracking remote work availability from North America’s largest 50,000 employers since the pandemic began, reports that 25% of jobs will be remote by the end of 2022 with this continuing to expand through 2023. A quarter may seem minimal, but to put it into context, remote high-paying jobs leaped from less than 4% to 9% after 2020 and by the end of 2021, doubled to almost 18%. These stats, coupled with the fact that the nation is facing a housing crisis, is enough for anyone to pause and consider converting their underperforming office building into market-rate apartments.

While 2020 marked the year of remote work, 2021 was the first year that apartment and office rent growth went in opposite directions. On a national level, office effective rent growth decreased by 0.8% in 2021. Decreases were also seen on a metropolitan level, as office market performance in cities such as New York, Tampa, and Orange County trended below the national average while apartment rents in the same markets increased, with the average apartment rent increasing 16.7% YOY, according to Moody’s Analytics.

Comparing the performance of offices and multifamily housing, a conversion seems like a no-brainer, however, there are several factors that must be analyzed, such as specific market demand, location, and profitability. Also, not all office spaces are created equal, the age of the office, as well as the structure itself needs to be considered. These circumstances make the process less straightforward and are likely the reason conversions are few and far between. However, office retrofits have many benefits including often being more economical than ground-up development, while also having a shorter timeline for completion.

CBRE found that from 2016 to 2020, converting office buildings for other uses occurred approximately 35 times per year. However, in 2022, the country is on pace to do 35 office-to-apartment conversions alone. In June, the largest office-to-apartment conversion, a 30-story office tower opened in 1967 in New York City was announced for retrofit into a multifamily housing building with 571 units. So, are office conversions here to curb the housing shortage? Likely not, however that doesn’t mean that conversions aren’t on the rise or that investors shouldn’t capitalize on this opportunity.

Cardinal Group Consulting specializes in providing consulting services to the student housing and conventional multifamily industries as well as niche sectors such as built-to-rent, office, and retail. We provide a diverse range of services including market research, due diligence, capital planning and pre-development design. For more information, contact consulting@cardinalgroup.com