A Tale of Two (Univer)Cities

Clemson University has ranked as a top student housing market for many years, displaying strong enrollment growth trends, large incoming freshman classes, and a competitive football team. With all these positive attributes, comes the attention of developers, flocking to invest in a thriving market. But how will this market perform while absorbing nearly 3K beds over the next few years? While we don’t have a crystal ball, we can predict this market’s future performance by analyzing a market with a similar past.

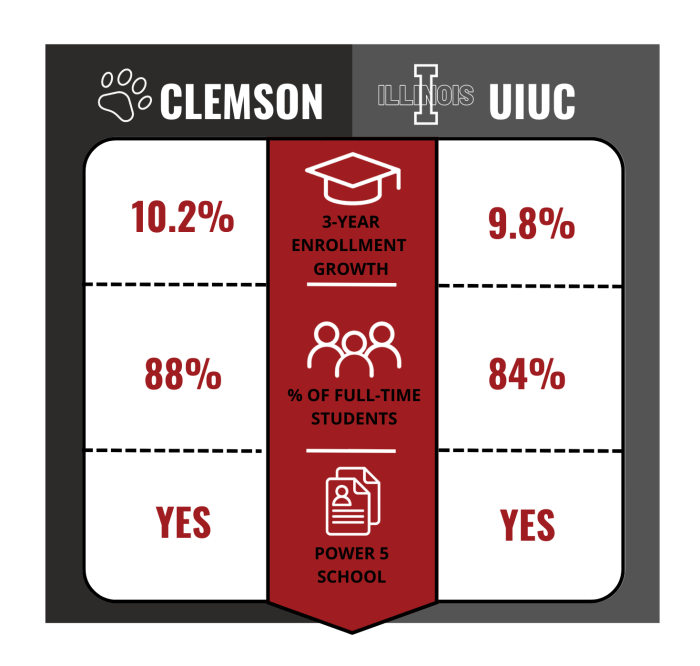

To determine a comparable market, Cardinal Group Consulting prospected trends of consistent enrollment increases, a similar percentage of full-time students, growing incoming classes, and surges in off-campus supply. Using these fundamentals, the team identified the University of Illinois Urbana-Champaign (UIUC) student housing market. The Champaign market has historically performed well, alluring developers and investors over the past ten years. However, during years of heavy development activity, off-campus properties faltered in terms of performance due to the market attempting to absorb an influx of new supply in a relatively small time frame.

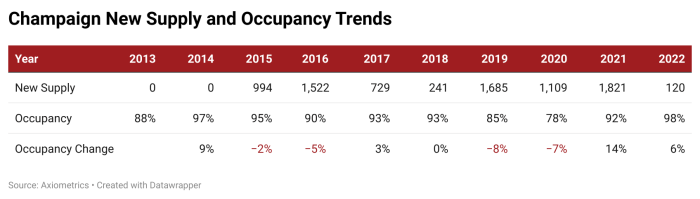

In 2016, Champaign saw its largest development wave since 1996, with over 1,500 new purpose-built beds delivered. Despite an increase in enrollment, the average market occupancy decreased by 5% as the market attempted to absorb the large number of beds. As enrollment continued to grow, the market started to rebound. However, in 2019 and 2020, there was another influx of new supply, with nearly 2,800 beds delivered. The 2020 academic year experienced an even more drastic decrease in occupancy due to COVID-19 impacts. Still, record enrollment growth in fall 2021, a 7.5% increase to be exact, allowed the Champaign market to make a quicker than expected rebound. The significant increase in enrollment can be attributed to a return, and increase, in international students, as well as notable increases in first-year and full-time enrollment, 10.3% and 7.7%, respectively.

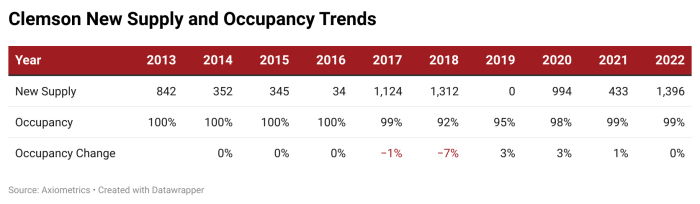

Clemson has also already experienced a blimp similar to Champaign’s. In 2017, over 1,100 beds were delivered and the market responded with a 1% decrease in market occupancy. A minimal decline, however the following year an additional 1,300 beds were delivered, and occupancy decreased by 7%. Enrollment increased in both 2017 and 2018, but performance was impacted as the market attempted to absorb over 2,400 beds in two leasing cycles. In fall 2022, another 1,400 beds were delivered, and occupancy remained unaffected, likely due to the significant increases in enrollment. Additionally, there are currently no new developments in the pipeline for fall 2023 which will grant the market additional time to absorb this new supply. This won’t be the case starting in 2024, though, when almost 3,000 beds are expected to deliver over the following three years.

The Clemson market has its own pros and cons which will contribute to its overall success, with one advantage being a larger percentage of full-time students than UIUC, who are more likely to be renters of off-campus purpose-built housing. The University also experienced considerable freshman growth over the past three years, with first-year enrollment increasing by 16.7% since 2019. A perceivable disadvantage is the on-campus bed supply, which has the capacity to house approximately 28% of enrollment, higher than the national average of 20% for universities with 20K+ students. The market also has an ample off-campus inventory, with approximately 10,400 purpose-built beds, equating to a market saturation rate of 73%. Typically, when markets reach 65% saturation, they will begin to see softening, realized through decreases in occupancy, lack of rent growth, or an increase in concessions. Champaign reached a market saturation rate of 50% in the fall of 2020, after the influx of new supply. With Clemson already above the threshold, it is more vulnerable to softening due to oversaturation.

Of course, no two markets or academic years are the same, and the Clemson market has the capability to react differently, either better or worse than the Champaign market did as it attempts to absorb new supply. More moderate enrollment increases could leave the market struggling to absorb the inundation of new beds. On the other hand, if total, full-time, and first-year enrollment continues to see significant increases the market could maintain high occupancies. Again, we cannot predict the future, but looking at the market’s historical performance and analyzing Champaign, a comparable market, one can forecast that the Clemson market will likely endure some softening as it continues to become oversaturated.

Cardinal Group Consulting specializes in providing consulting services to the student housing and conventional multifamily industries as well as niche sectors such as built-to-rent, office, and retail. We provide a diverse range of services including market research, due diligence, capital planning, and pre-development design. For more information, contact consulting@cardinalgroup.com